NatWest drama¶

2642 words

So far my bank in the UK, NatWest, have been quite good for a bank. While I was always bemused by the cultural differences between banking systems, like the fact that cheque payments were considered to be more than joke from the past century, that they’d give me a credit card with almost 2000 quid credit when I had no money to back that, the fuss they made about card payments, the ‘chip and PIN’ stuff, or the whole thing that a country without ID cards gives you: A plastic university card being taken as as good an ID as a state issued ID card is. However, all this caused at most sad smiles and no real trouble.

A thing that was and remains more troublesome/sad is their online banking service because they try to keep that as Mac incompatible as possible and throughout its existence forced me to use a different browser than I want to use or at least make the browser send a ‘fake’ identification string to be able to use it (they’ll even deny access to you today if you’re using Safari 3). I may discuss amusing aspects of online banking services another day.

A thing I particularly liked about NatWest was that they tried to be hassle-free. After moving back to Germany I told them about it and they said it’s not a problem to keep my account in case I come back at some stage. No fees, no trouble. Cool.

Just that it wasn’t. Things went slightly wrong last autumn when I had forgotten about a standing direct debit on my account and it ran out of money. As I have no overdraft on the account (yeah, they gave me a big credit card account but no overdraft on the normal one, different arm of their operations…) this caused the transaction to fail. And I quickly received a letter telling me that. And the fact that they’ll charge me £38 for the privilege. £20 direct debit transaction, £15 in the account. And bam! £38 for the bank so one of their clerks can remove the finger from his butt, press a button on a computer and put the finger back where it belongs. Or so I imagine anyway. I took this as a lesson. And as a hint to why banks are so filthily rich and possibly why people like the inconvenience of paying by cheque in the UK.

As soon as I learned this, I had a friend put £50 into my account to take care of those fees and prevent things from going wrong further. File as: a lesson learned, an expensive one. And I didn’t hear back, so things were fine. That’s what I thought anyway.

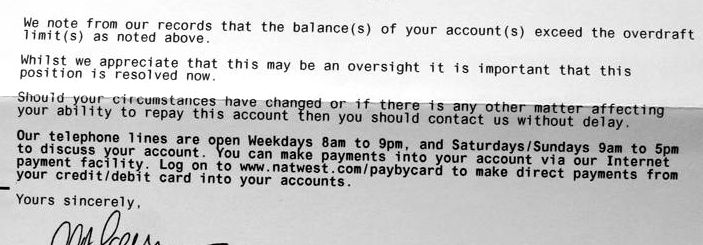

Until I received a letter recently from NatWest’s ‘Collections Centre’ telling me that my account is almost £300 overdrawn. Gulp! I checked online and could only see the last three months’ data there. But judging from that I started thinking that I wasn’t a victim of some online fraud but rather one of the fraud known normal banking procedures. Apparently the bank deducted around £30 per month from my account as ‘fees’. With about ten months having passed since my previous problem I suspected something went wrong there and the total amount added up in this way.

It was a mystery to me, however, what could have gone wrong there and why they didn’t tell me. For that kind of money even a bank can send you a letter, right? So off I was to call centre hell.

Of course we all have the lowest opinions about call centres. Not necessarily about their staff, but quite necessarily about the spirit they are run in, the training their staff get and the general incompetence and inconvenience they represent. And reading the ‘0845’ national rate number on the letter also present an additional problem. Calling those numbers within the UK isn’t cheap but tolerable. Calling them from abroad, however, can be a complete rip-off. I definitely don’t want to pay €1 per minute just to get into endless waiting loops, mindless navigation systems and underinformed staff. Luckily I could find a phone provider (which thanks to Germany’s nicely regulated/demonopolised phone market merely means prefixing the number with an additional code when dialing) doing that for 12c/minute, which was tolerable.

And there I was, phoning ‘Birmingham Collections Centre’, open 8-21 on weekdays on +44-845-3311684. The call started with some blah-blah-blah asked me for the case number and then led to a menu which didn’t contain any options applying to my case, i.e. to learning about what went on and quite likely to dispute it and neither an item for ‘anything else’. So I selected numbers quasi-randomly and eventually spoke to a person. Good.

I was asked about some credentials, explained the situation and then asked about what had happened. The bottom line of that was the person on the line reading out the exact stuff I already received as a letter and seen in my online banking. I then learned that because it was after seven in the evening or so, they couldn’t actually access my full file and essentially couldn’t help me in any way. Great that their lines are open until nine, though!

Just to be on the safe side, I asked them to note that I called and that I think something is wrong, so it’s clear I reacted promptly. I also asked them for a number that’s easier to call internationally and that doesn’t have a menu without any applicable option. They gave me the number +44-151-7335814 which I was to call the next morning.

When I called that number the next day, I fairly quickly learned that, yes, this was a NatWest phone number but they had absolutely no idea what I was calling about. However, I was put through to some other office where, after another round of forwarding, I eventually spoke to someone at least feeling somewhat competent. We went through my file and finally understood what had happened (they tried to do the £20 direct debit, which failed, so they charged me £38 for that, I paid in £50 to cover that, the next month they deducted another £28 because deducting the £38 overdrew my account). This looks completely absurd to me because if the account cannot pay £20, it quite naturally cannot pay £38, but the real issue here was that they just didn’t let me know about any of that. And so they went on, deducting money month after month, until ‘my’ balance was around -£300.

I told the person on the phone that, definitely, they should have told me about these things happening and that obviously I would have reacted immediately had I known about any of that. To which they responded that they did send me statements with all the info. Which they didn’t. I hadn’t thought much about this. I was out of country, I wasn’t using the account, so why should they send me statements? Just seems like a waste of paper and postage. But obviously that’s not how banking works. Trees need to die, letters need to be sent. And the person at the call centre kept insisting that they did send me statements. To which I could only say that, yes, it’s definitely possible that a letter gets lost. But monthly letters getting lost for almost a year seemed unlikely to me. Extremely unlikely.

After some more insisting and making sure that they have my correct address (bonus quiz: how else could they have sent me that letter about the overdraft problem?) I got them to send it to some investigation unit to find out what was going on there. As this was to take a week, I also told them to note that this is being investigated and that no further charges should be added while that happens (the end of month being near, after all).

I also told them that I’d be perfectly happy if they kept me updated via e-mail as this was somewhat urgent and international mail can be slow. The bottom line of that was – of course? – that they don’t do e-mail. But they wondered about not having a phone number of mine (and agreed that them having foreign numbers, possibly answered by people speaking German might not be that helpful). So there I was, on the way to sorting this out, right?

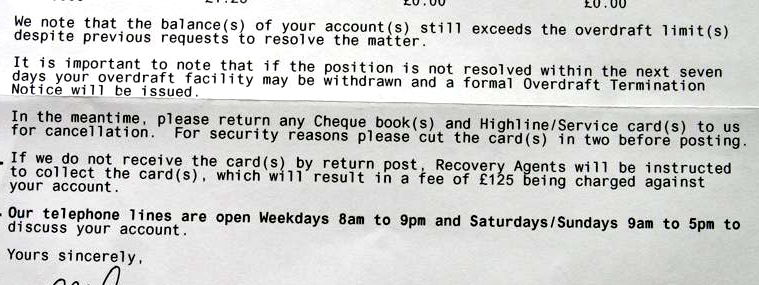

At least that’s what I thought until the next day when another letter from NatWest arrived, posted just three days after the first one and before I called them. Despite talking to people on the phone that second letter was never mentioned (and we did refer to letters explicitly by date). That letter contained a somewhat threatening language in its classy 1980s style monospaced text and it told me to please return any Cheque book(s) and Highline/Service card(s) to us for cancellation. […] If we do not receive the card(s) by return post, Recovery Agents will be instructed to collect the card(s), which will result in a fee of £125 being charged against your account. […] Yours sincerely,

So let me just overlook their creative use of capital letters and look at the text: They are extremely threatening there. They threaten, sincerey

, nonetheless to send over Recovery Agents

which probably are those burly guys from the Russian mafia who were too unfriendly to get a job as a bouncer. And they put this in pseudo-neutral business speak to make it look all legitimate. In addition to that, the letter doesn’t even state what exactly they want me to return, so, err, WTF? Is this a legitimate business or some bunch of crooks I’m dealing with here?

As I start suspecting the latter, another phone call was due. I first tried the +44-151-7335814 number again but they stop working at six and weren’t available. So I was back to the +44-845-3311684 number. I had to explain the whole situation again and staff didn’t really try to be helpful. It also seemed that they had no knowledge whatsoever about the call I made the day before and the ‘investigation’ that was supposed to be done.

I insisted that they make another note that I called, that things are being investigated and that none of the threatened actions be taken for the time being. Allegedly that was done. But to pretty much all the questions I asked I got the impression that the ‘Collection Centre’s attitude was that it’s not their problem and they have no idea what they are doing. For example I explained that I hadn’t received no statements and I also saw that – quite possibly due to the same problem – I hadn’t received my new Switch card when the old one had expired. So I cannot possibly return my Switch card to them. I wanted them to note all that as well. As with all the threatening tone and incompetence at work I could totally see them sending around people to pick stuff up. And good luck explaining such details to someone whose weight (in kg) is twice his IQ when he arrives at my door…

The bottom line that came out of this phone call was that if I actually wanted to learn anything about my file I need to go to my local branch and speak to people there. I carefully pointed out that I am living in a different country – as they are very well aware of – and that this isn’t an option (it’s not the first time I saw this kind of idiocy with call centres, they have all the information right in front of them but they just don’t add things together). So, they suggested, I should try to call the branch holding the account. And jup they’d quickly look up the number for me. Helpful, great. Just that after a few minutes they couldn’t find the phone number of one of their own branches. Uh, core incompetence 101 was passed successfully, I guess.

The next morning I then looked up the supposed number of their University of Warwick branch. It was impossible to find. NatWest’s web site listed the same number (0845-3019495) for all their Coventry branches, some other web sites list yet different numbers (which don’t work or seem to be fax lines, just as NatWest’s other phone lines like giving you a fax/modem reply occasionally) and nobody lists an actual local phone number for the branch. So that other 0845 number it was.

After cycling the hold messages for a while, being assured that I’m very important to them, I was put through. Having gotten a bit into the mood of the whole call centre thing I asked whom I am speaking to to begin with. Turned out it was the Birmingham branch. I explained that I needed to speak to the Coventry branch and, haha, had dialled their number for exactly that reason. And the person on the phone explained that the phone system redirects calls in this way when lines are too busy but she’ll try to put me through.

Soon after I was put through. I ran through the usual pseudo security stuff once more, my file was looked at and it appeared that for the first time in this odyssey I spoke to a person who actually knew what she was doing, was trying to understand the problem and to resolve it. She quickly spotted that for some reason my address wasn’t updated in their local system and that this caused all the problems. She couldn’t see why that happened but immediately offered to refund the charges and interest deducted as a cause of this. She also said I should send a letter with my curent address to their branch as they need address changes in writing.

And thus it seems that, ultimately, my problem has been resolved. Computer errors can happen, but how you deal with them is the big issue. And NatWest seem to have a problem with that. As things went, this does leave a bitter aftertaste because of all the hassle it caused me and because it upset me. If you are dealing with huge corporations it always seems entirely possible that they will be able to get away with removing £300 from your account and not telling you either because they have the right nasty sentences somewhere in the back pages of their terms and conditions or simply because they decide that your cost to take on their legal department may make it unlikely for you to challenge them. It turns out that NatWest aren’t that kind of bastards, but I feared the worst until things were resolved.

However, NatWest’s processes here could have been much better. If their initial letter had explicitly stated what was going on and listed helpful phone numbers, I could have resolved this much more quickly and with much less hassle. Instead I spoke to many people who apparently had no interest in even understanding the problem, I was given phone numbers that shouldn’t even exist and throughout this process didn’t get good updates about what is happening. I also started wondering whether it might be a good idea to have a way to record phone calls as obviously the records taken by ‘their’ call centre are neither trustworthy nor reliable.

Finally, I was left with the impression that this entity which presents itself as a single bank seems to consist of many different parts who, as a matter of principle, have no idea what they are doing and why. And who cannot or do not want to put pieces together but are content with pushing you around to yet another person with a headset as they can shift the burden an ‘responsibility’ in that way.